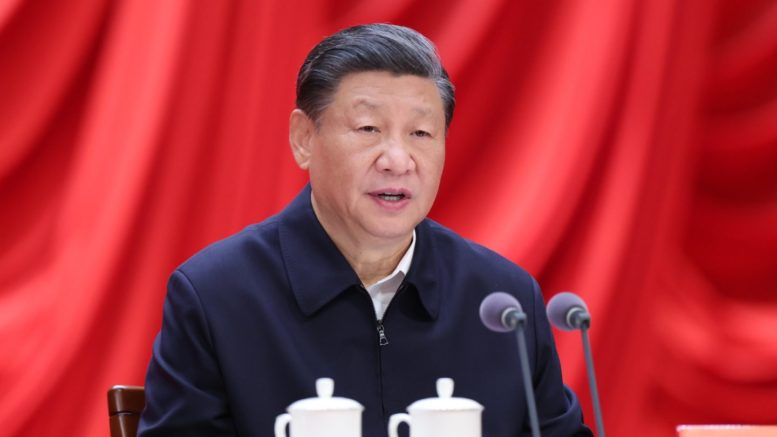

Expectations are growing for a more assertive response from the Chinese government to address the ongoing stock market turmoil, with regulators set to brief President Xi Jinping on the situation as early as Tuesday.

Following reports that regulators, led by the China Securities Regulatory Commission, are planning to update top leadership on market conditions and policy initiatives, Chinese stocks experienced a notable rebound. The CSI 300 benchmark surged by 3.5%, marking its best performance since late 2022, while small-cap equities, which had been heavily impacted by the downturn, also saw significant gains.

While the outcome of the meeting remains uncertain, traders are optimistic that renewed efforts from policymakers could signal a shift in market sentiment. The significant decline in equity values, totaling $7 trillion since their peak in 2021, has prompted calls for more decisive action to stabilize the market, especially as China approaches the weeklong Lunar New Year holiday.

The prospect of President Xi Jinping convening a meeting is seen as a positive development, indicating a heightened level of concern within the authorities. According to Li Weiqing, a fund manager at JH Investment Management Co., this signals a proactive stance from the government, potentially instilling confidence among investors.

Earlier in the day, supportive measures were announced, including Central Huijin Investment Ltd.’s commitment to purchasing more exchange-traded funds and assurances from the securities watchdog regarding efforts to maintain market stability. Additionally, foreign inflows surged, with overseas funds injecting over 12 billion yuan ($1.7 billion) into mainland shares on Tuesday, the highest amount recorded this year.

Despite these efforts, there remains a risk of disappointment if the outcomes of the meeting fail to meet expectations, potentially triggering another wave of selling. Past attempts to support the market, such as those seen during the 2015 equity crash, have shown mixed results, with sustained rallies proving elusive.

The increasing involvement of President Xi Jinping in financial and economic policies underscores the gravity of the situation. Authorities have been intensively working to devise market rescue measures, including tightening trading restrictions and holding numerous meetings on stabilizing capital markets.

However, previous measures, including curbs on short selling and state intervention in bank shares, have had limited success in restoring investor confidence. Lingering concerns over economic slowdowns and regulatory crackdowns have contributed to ongoing market volatility.

Despite the recent rebound, Chinese equity benchmarks continue to underperform compared to global indices, reflecting the challenges facing the market. Observers suggest that a potential pivot point may be reached if concerted actions are taken, indicating a more coordinated approach to addressing the crisis.